2025 Limited Fsa Maximum Contribution - The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2023 amounts. FSAHSA Contribution Limits for 2025, Our bulletin breaks down the 2025 health fsa contribution limits issued by the irs for health plan sponsors and plan participants. The irs released 2025 contribution limits for medical flexible spending accounts (medical fsas), commuter benefits, and more as part of revenue procedure.

The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2023 amounts.

Here’s what you need to know about new contribution limits compared to last year.

Has Irs Announced Fsa Limits For 2025 Jojo Roslyn, What is the 2025 maximum fsa contribution? For employer sponsored plans including 401 (k), 403 (b) and 457 retirement plans—as well as thrift savings plans, a type of.

401 (k) contribution limits 2025. For 2025, there is a $150 increase to the contribution limit for these accounts.

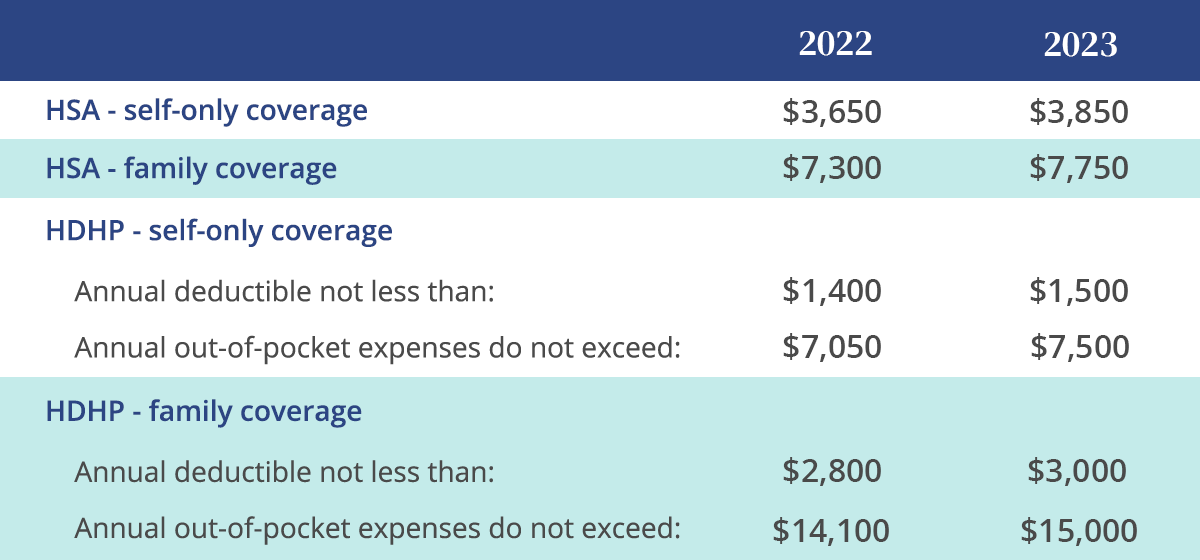

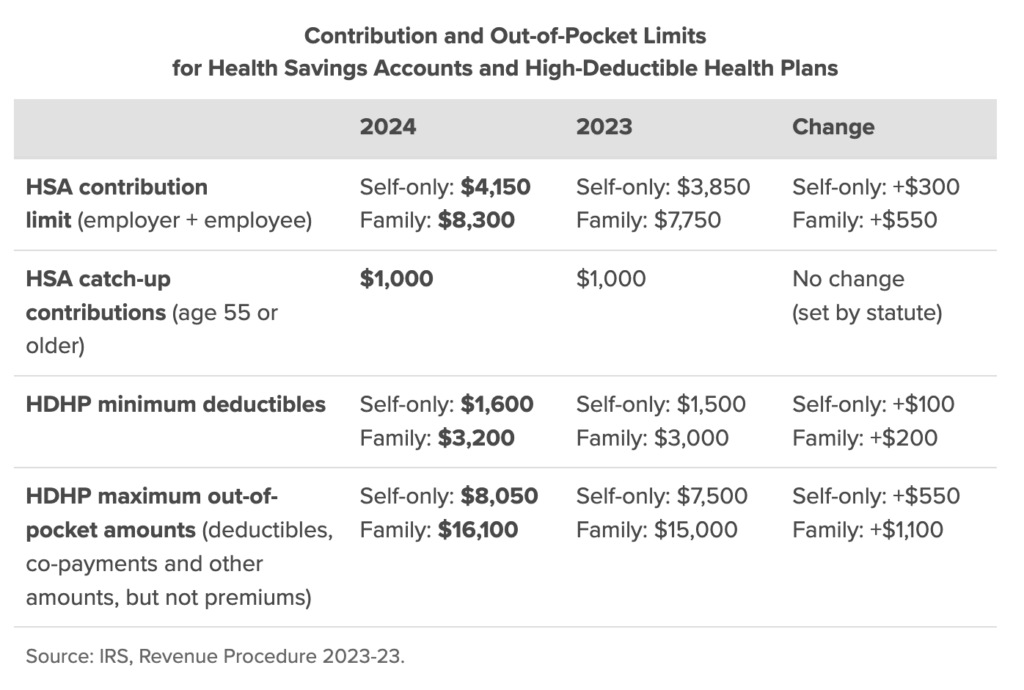

2025 Fsa Hsa Limits Tommi Isabelle, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2023). Amounts contributed are not subject to.

Fsa Allowable Expenses 2025 Lori Sileas, 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200. What is the 2025 maximum fsa contribution?

IRS Raises 2025 Employee FSA Contribution Limit to 3,200 NTD, Employees can now contribute $150 more. Some employees may be able to eliminate more taxes next year and save more money because the irs has announced new increased contribution limits to.

Max Fsa Contribution 2025 Carol Stormi, The irs set a maximum fsa contribution limit for 2025 at $3,200 per qualified fsa ($150 more than the prior year). Under federal law, both also have an annual contribution limit of $3,050 in 2023, rising to $3,200 in 2025.

.png)

401K Contribution Limits 2025 Dulcy Glennis, Here’s what you need to know about new contribution limits compared to last year. For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2023.

Fsa Contribution Limits 2025 Averil Devondra, 1, 2025, the contribution limit for health fsas will increase another $150 to $3,200. An lpfsa can be used.

An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year. What is the 2025 maximum fsa contribution?